Envision the Outcomes, Achieve the Results

Welcome to the College of Business at Western New England University! Our mission is to empower you to lead a successful career in business or in a business-related field. We are committed to providing you with the tools you need to navigate the ever-changing world of business, network, and serve in leadership positions in your career and within your community.

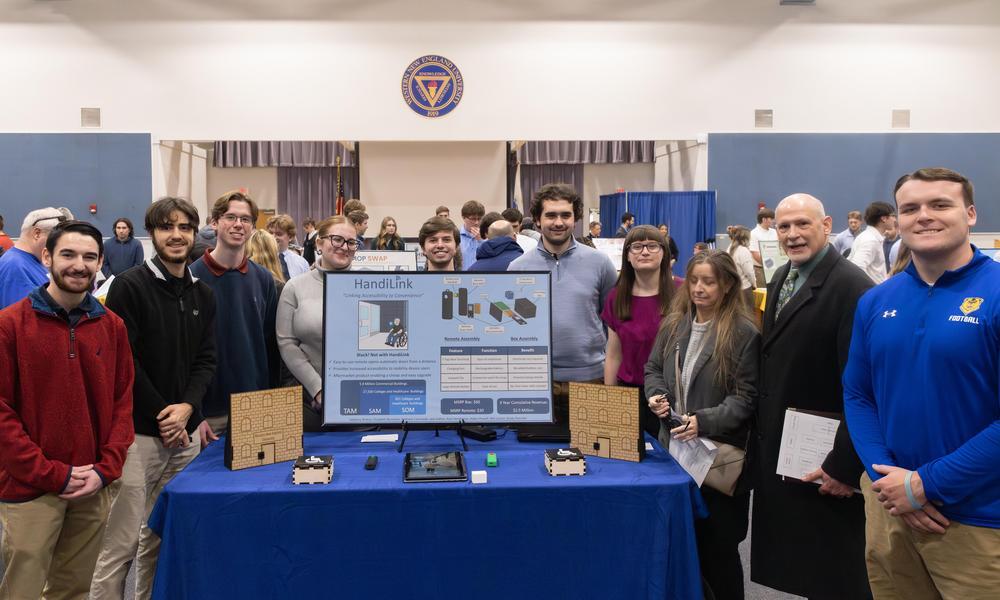

More than just a business school, the College of Business at WNE offers a wide variety of undergraduate and graduate degrees as well as time- and tuition-saving combined degree programs. With an excellent staff of knowledgeable instructors, flexible programs, and the highest business accreditation in the world, our graduates have gone on to become CEOs and CFOs of banks and financial institutions, executives in insurance and manufacturing industries, top healthcare and nonprofit professionals, and entrepreneurs. Whether you're interested in General Business, Entrepreneurship, Marketing, or something else, you'll discover courses and unique learning opportunities that set you up to achieve excellence—not just at WNE, but wherever your career takes you.